What Are Your Options When Over Miles On A Lease?

By Jakob Hansen, 6/3/2020

When over miles and deep into the hole, what options do you have?

It happens to the best of us. You get into a lease, expecting to only drive 10,000 miles a year, and then BOOM, a year a half goes by, and you’ve already put 23,000 miles on your lease. So what do you do? What options do you have and how can you get out of the situation in the best way possible?

Your situation is more common than you think. We speak to consumers in a similar predicament everyday. First off, take a breath. Everything will be okay. There are still options for you.

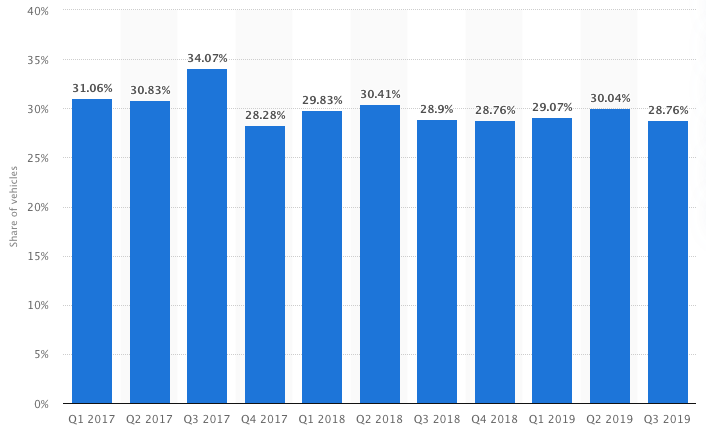

It is projected that lessee customers will make up more than 34% of car buyers in 2020, make sure you are on the right side of your next lease.

Statista

How Did You Get Here

To start, we need to look at what happened. Where did it all go wrong? Many people have run into this situation, and whatever the cause of your over mileage; change of job, unexpected travel, or just an overzealous teenager, you need to establish what caused the overage so that it doesn’t happen again.

Perhaps a lease is not the best option for you. You may want to consider purchasing your next vehicle. Getting out of a lease and into a financed vehicle is an easy changeover and some dealers will be happy to assist. Both leasing and buying have their benefits, and while purchasing sometimes comes with a higher monthly payment, it's nowhere near the overage fees that come along with going over your miles.

Next, we need to look at what you plan to do. Here’s where you have several choices to play with. Each option comes with its sacrifices, but avoiding the several thousand dollar hit you’re facing when the lease is worth it.

Option 1: Stop Driving The Vehicle

The first option that you have is to stop driving your vehicle altogether. While this option does come with its downfalls, it is the most logical approach to the situation you are in.

Unfortunately, this is not an option for most lessees. For most of you, your lease is your primary vehicle. Average car buyers don't have extra cars just laying around.

Not to mention, it flat out stinks having a car sitting around. Paying down on a car that you can't drive is about as frustrating as trying to install a car seat in a Porsche. Trust us, we've done it.

So if letting your car sit for several months before your lease is up isn't an option, what else do you have?

Option 2: Purchase Your Lease

The second option is to purchase your vehicle after your lease is up and keep it until you have balanced out your negative equity. For some of you, this may be the best solution. If you like your lease and it works well for you or your family, then keeping it for another couple of years won't be any sweat off your brow.

This solution is a useful way to avoid being hit with giant overage fees. Keeping the car for several years after you buy out your lease will give your payments some time to catch up with the cars slowing depreciation.

Unfortunately, this scenario requires you to pay dealer fees and taxes TWICE. Once when you lease and again when you buy your lease.

If purchasing your lease is not kosher for your situation, there are still open doors for you.

Option 3: Lease Pull Ahead

In our experience, lease pull ahead is the best option for shoppers in your situation. Lease pull ahead is when manufacturers or dealers offer you the option to turn in your lease early, allowing you to get into a new lease or financed vehicle.

Most brands have lease pull ahead programs. Often times these specials will cover your remaining payments and wave the early lease termination fees. Dealers want you to purchase a new vehicle from them and will offer you incentives to get shoppers like you in the door. Unfortunately, lease pull ahead offers are not always advertised, leaving you to waste your precious time seeking out the deals on your own.

How to Find Your Lease Pull Ahead Offers?

Finding lease specials doesn't have to be so hard. There are many tricks and trade secrets to find great deals online, but most are inaccessible without credentials or payment. Our free and easy to use tool give you the best deals in your area, without requiring anything from you.

The simple, streamlined tool gets you instantly connected with qualified, accredited dealers in your local area. Each dealer is able to offer you their best price, without you having to walk in the door, much less leave your couch.

The qualified partners that we work with have no other goal than getting you into a new lease. We don't push one brand over another, we don't sell your information to those that don't need it, and we do not want a million people calling you.

Only the best local dealers that you choose will reach out, providing you with their best deals available right now.

No haggling, no negotiation. Just simple, easy pricing.

As we like to say, when dealers compete, you win.

The Dealer Is There To Help

Regardless of your situation, don't stress. The dealers know all the best practices to get you in a lease at an affordable price. Remember, their goal isn't to scare you away, it's to sell you a car. They are going to make sure they can get you into the right vehicle at a price that you can afford.

As a lessee, you are a valuable customer to the dealer. Every 2-3 years, you will be ready to buy again, so providing you with a satisfactory experience is of the utmost importance. Ensuring you drive away happy and satisfied with your deal secures them as the first dealer you call when your lease is up.

Ultimately, there are options for you. Check on lease pull ahead, go over the vehicle you are interested in, and get out of that over mileage lease before its too late!

|

|

Jakob is our writer with a love for all things automotive. He comes from a dealer background with experience on both sides of the fence. Knowing the system inside and out, he knows the best cars and the best deals. No matter what. |